by Matthew Bullock, Sabrina Geppert and Mario Aguilar De Irmay, CFA

Key takeaways:

- Healthcare has traditionally been an effective portfolio buffer during periods of volatility, with healthcare and the biotech subsector proving to be more insulated from the market drawdown in 2022.

- Expert knowledge is critical to identifying winners that can take advantage of the speed of innovation happening in the sector.

- We think an active and nimble approach is key to finding companies that stand to benefit from the long-term tailwinds that healthcare and biotech can provide.

Given the market volatility of 2022 and a slowing world economy, it is understandable that investors might want to tread carefully. Yet, such periods can uncover attractive investment opportunities, including assets with both defensive characteristics and growth potential. From a portfolio construction point of view, this translates into investments that can provide uncorrelated returns and help protect against drawdowns.

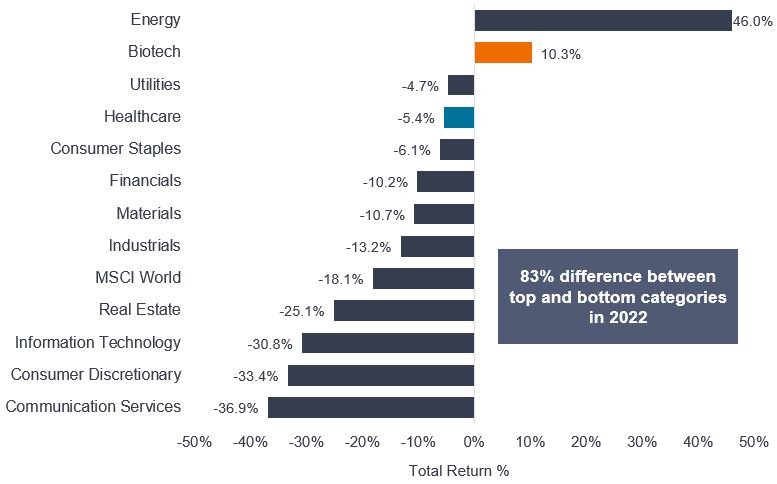

To that end, we believe investors could benefit from an allocation to healthcare. The sector has historically captured less downside during market sell-offs, and also benefits from structural tailwinds such as aging populations and rapid innovation. In 2022, for example, most global equity sectors experienced material losses (see Exhibit 1), yet healthcare broadly and the biotech subsector specifically were more insulated from the pain.

The question from a portfolio construction perspective is, why was that the case, and can we expect similar characteristics going forward?

Exhibit 1: Global equity sector returns for 2022

Source: Morningstar, global equity sectors and subsectors based on MSCI World Index, as at 31 December 2022. Past performance does not predict future returns.

Can healthcare provide immunity from the downturn?

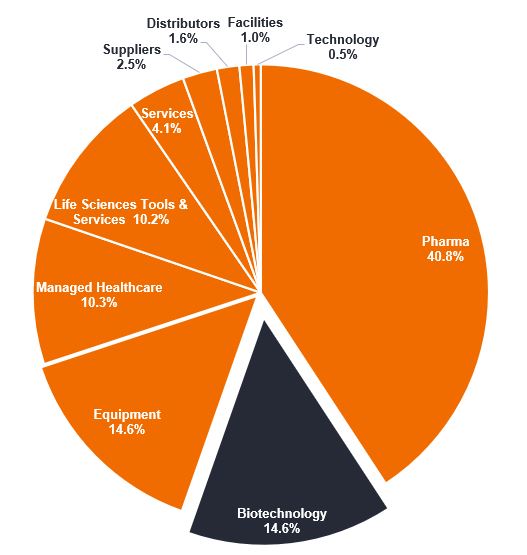

Healthcare has traditionally been an effective portfolio buffer during periods of volatility due to steady consumer demand for hospitals, medicines, and medical devices irrespective of market conditions. This is true for approximately 85% of the sector, which is made up of pharmaceuticals, medical devices, and health care services, all of which reflect the “defensive” characteristic we mentioned earlier.

The remaining 15% of the sector is made up of biotechnology firms. This subsector includes innovative – and inherently volatile – small- and mid-cap firms that offer greater growth potential, as well as large-cap firms that reflect more defensive qualities and tend to behave similarly to traditional pharmaceutical companies.

Exhibit 2: Breakdown of the global healthcare sector

Source: MSCI, composition of the MSCI World Health Care Index as at 31 December 2022.

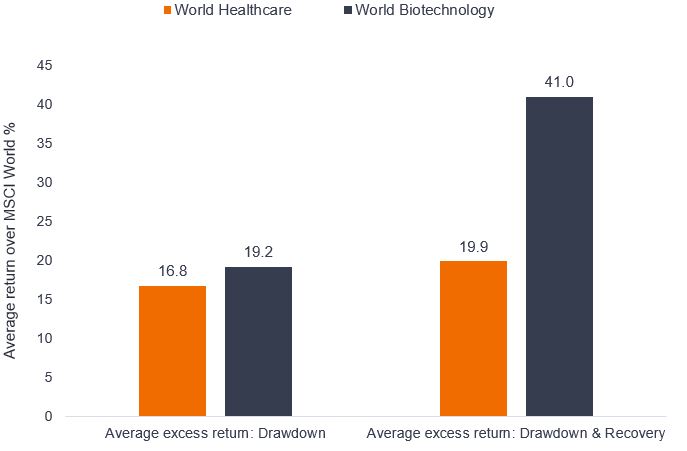

These defensive and growth characteristics are reflected in historical returns. Exhibit 3 shows the performance of the healthcare sector and biotechnology subsector relative to global equities (excess return) during the past five market drawdowns and subsequent recoveries. While we would expect healthcare to outperform across the full cycle of drawdown and recovery due to its defensive nature, biotech has ultimately shown better performance, highlighting its capacity for alpha generation.

Exhibit 3: Average excess return vs MSCI World for past 5 market drawdowns and recoveries since 2000

Source: Morningstar. Global equity sectors and subsectors based on MSCI World Index. Average of downturn periods are 1/4/00 – 9/10/02, 1/11/07 – 9/3/09, 3/5/11 – 4/10/11, 13/2/20 – 23/3/20, 5/1/22 – 12/10/22. Recovery periods are based on MSCI World, for the final period 31/12/22 in the case of the recent recovery. *Last market downturn period recovery and full cycle end date is as at 12 December 2022. Past performance does not predict future returns.

A specialist field requires active management

It is estimated that 90% of drugs that enter human clinical trials never make it to market, and for those that do, our experience shows that consensus sales estimates for new drug launches are wrong 90% of the time.1 Therefore, expert knowledge and understanding of the scientific research, testing, and drug approval process, plus a skilful assessment of the related commercial opportunities, is critical to identifying winners that can take advantage of the speed of innovation happening in the sector.

At the same time, the market drawdown in 2022 caused a rerating of price-to-earnings ratios for healthcare stocks, with ratios dropping precipitously from recent highs. This rerating was particularly pronounced in the small- and mid-cap biotech space. In fact, roughly 200 of these companies now trade below the levels of cash on their balance sheets,2creating the opportunity for idiosyncratic events (e.g., positive clinical trial updates) to drive significant upside.

Therefore, we think an active and nimble approach is key to finding those companies that stand to benefit from the many long-term tailwinds that healthcare and biotech can provide, as well as uncovering opportunities borne out of market inefficiencies.

Matthew Bullock is EMEA Head of Portfolio Construction and Strategy / Sabrina Geppert and Mario Aguilar De Irmay, CFA are Senior Portfolio Strategists