Street talk has revealed that a mystery bidder has outbid Albemarle’s (NYSE: ALB) $2.50 per share offer for Liontown Resources (ASX: LTR).

Reports are suggesting that Wesfarmers (ASX: WES), the Chilean conglomerate SQM, a partnership involving IGO (ASX: IGO) and Tianqi, as well as South32 (ASX: S32) and Fortescue Metals (ASX: FMG), could be suitable contenders.

Whoever it may be, the bidder has set a limit for $2.75 per Liontown Resources share, signalling that the offer for the emerging Tier 1 Battery Minerals producer with a market cap of around A$6bn would be around that figure.

The offer follows recent activity by the cashed-up lithium producing bellwethers, including SQM acquiring a 19.99% stake in Azure Minerals (ASX: AZS), and Chris Ellison’s Mineral Resources’ (ASX: MIN) 19.55% stake in lithium explorer Essential Metals (ASX: ESS), blocking the planned acquisition by IGO and Chinese partner Tianqi’s $136 million takeover offer.

However, whilst the heavyweight lithium players are thriving, the story couldn’t be more different for the smaller players in the sector – i.e., the explorers, developers and early producers.

Sayona Mining (ASX: SYA), Core Lithium (ASX: CXO) and Lake Resources (ASX: LKE) are currently the 4th, 5th, and 6th most-shorted stocks in the ASX, whilst Vulcan Energy (ASX: VUL) is 15th.

And in the last 12-months, shares of Sayona Mining have fallen by 26%, Core Lithium by 21%, Lake Resources by 72%, and Vulcan Energy by 18%.

A similar story with these smaller lithium players exists on an international scale.

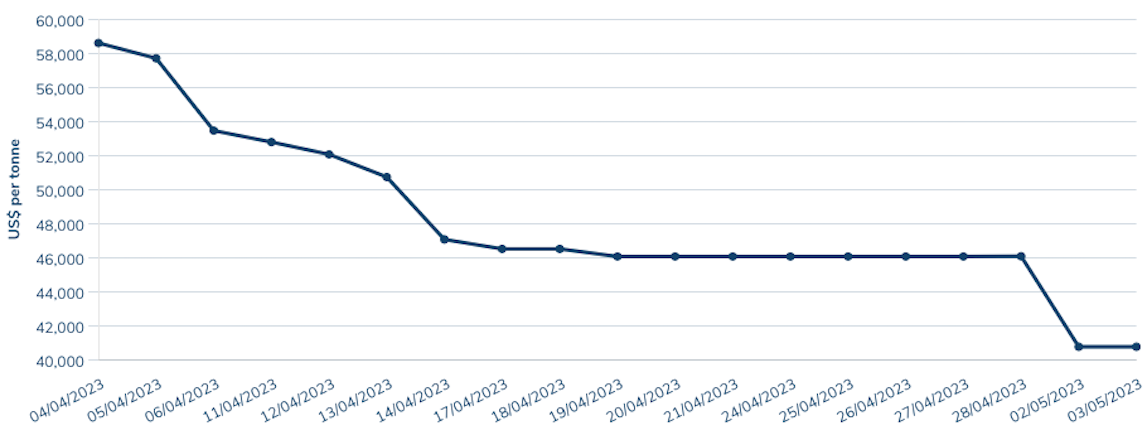

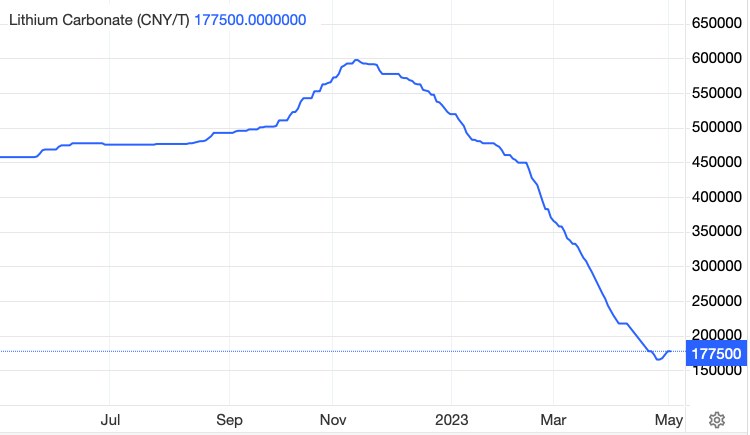

Rising interest rates have contributed to falling stock prices. However, as you might expect, the main driver has been falling lithium prices – both lithium carbonate and lithium hydroxide.

Source: London Metal Exchange

Source: Trading Economics

Whilst the price of lithium has fallen drastically, EV sales have increased, growing by around 60% in 2022. The intergovernmental body, the International Energy Agency (IEA), is forecasting EV sales will increase 35% from 2022 to 2023, which would mean EVs account for 18% of total car sales worldwide (the current figure is at 14%).

Additionally, the price falls have occurred even as major lithium countries struggle to keep up with demand.

The same is true for other key battery materials, including cobalt, which has seen its price fall by 32.77% since the beginning of 2023, and copper, which slipped 18% at one point this year.

For months, China has stopped buying lithium from the open market, instead using their current stockpiles to feed the current demand, driving down its price.

China is the largest consumer of the key battery ingredient so they can essentially manipulate its price.

Their impact can be compared to the actions of oil producing powerhouse OPEC+, whose announcement of cuts to production in recent months has boosted the price of oil.

However, these stockpiles have now gotten so low that China has begun re-buying from the open market.

Jesline Tang, a non-ferrous metals pricing analyst at S&P Global Commodity Insights, commented, “There’s also talk of declining inventories at battery makers, which could drive restocking activity.”

China’s influence has obviously been hurting the smaller players, especially at a time when obtaining funding to becoming a producer is significantly more difficult.

Even when economic conditions are sound, the process of becoming a producer is difficult. Companies have to navigate myriad technical challenges, requiring a significant amount of expertise, as well as operational challenges such as ore extraction, processing, transportation, and logistics.

9-12 months ago, when lithium stocks were booming, companies could raise funds by issuing equity. At this time, cost of debt was also cheaper.

However, as these stocks prices have been falling, and interest rates have been rising, companies are finding it increasingly difficult to raise funds for operations.

Several have been lucky to obtain funds through the signing of offtake agreements.

The US has been on the ball with this.

In recent months, Tesla (NASDAQ: TSLA) has agreed to amend its previous offtake agreement with Piedmont Lithium (ASX: PLL) to supply lithium concentrate for the next 3 years.

Ford Motors (NYSE: F) also signed a binding offtake agreement with Ioneer (ASX: INR).

They have also been providing equity investments to EV players, including General Motors (NYSE: GM) investing $69 million equity stake in Queensland Pacific Metals (ASX: QPM).

However, whilst the US companies have been actively investing, European EV companies have been asleep at the wheel.

There are now signs that this will change.

When referring to their shared project with Bayrock Resources in Sweden, QX Resources (ASX: QXR) Managing Director Steve Promnitz commented, “end users are now actively looking for these sorts of assets,” whereby end users refers to the car makers, battery makers, cathode makers.

Mr. Promnitz also brought to light the fact that there are not that many projects around, especially when catering for the huge demand growth for EVs, meaning these end users need to get involved once a project gets to a resource or a feasibility study, in order to secure future supply of the likes of battery components including lithium, nickel, graphite etc.

To support this, there have within the last week been reports that the EU is willing to proceed on a critical minerals’ agreement with the US. The agreement involves removing trade barriers from Joe Biden’s Inflation Reduction Act. The deal encompasses cobalt, graphite, lithium, manganese, and nickel, and will function as a free trade agreement, allowing electric vehicles that incorporate vital minerals extracted from the EU to qualify for subsidies.

As China starts to buy lithium from the open market, and funding from the EU and US is increased through offtake agreement and equity offerings, the next twelve months should be brighter for the lithium lightweights than the previous twelve. With increased funding, these small players should be able to excel at becoming producers at a faster pace, providing much needed support to the surging EV demand.