If the RBA wants to cut rates, it has a lot more freedom than just the low inflation figures for the September quarter, released yesterday, to justify a cut.

While the markets reckon a cut is very possible, don’t hold your breath – we have already seen two cuts this year and the RBA always points out that it can take a year or more for the impact of rate reductions to work their way through the economy.

The softer figure for the September quarter caught markets off-guard and down went the dollar – a half a cent at one stage – but that was due to markets believing their own views of life than having a wider view – the RBA has made it clear for a while it sees no fears from inflation for the next year or more.

The headline consumer price index rose 0.5% in the September quarter down from an 0.7% rise in the three months to June 30.

That was below markets expectations for an 0.7% rise. The annual rate was an unchanged 1.5%, but again softer than market expectations for a 1.7% rise.

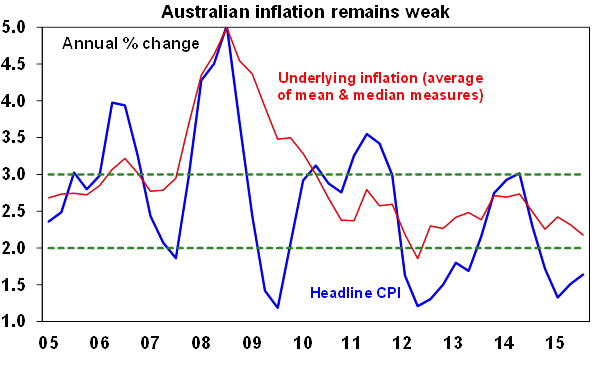

On the RBA’s preferred underlying measure – the trimmed mean (and the weighted median) – inflation rose 0.3% in the September quarter, slowing from 0.6% in the June quarter and below forecasts of 0.5%.

The annual average for the two underlying measures was 2.15%, which is at the low end of the RBA’s target range of 2% to 3%, and the lowest for three years. And market goods and services excluding volatile items also rose by just 0.4% quarter on quarter and 1.7% over the year.

The Bureau of Statistics said the most significant price rises this quarter were in international holiday travel and accommodation and property rates and charges (all up 4.6%) and fruit ( up 8.2%).

These rises were partially offset by falls in vegetables (down 5.9%), telecommunication equipment and services (off 2%) and automotive fuel ( down 1.7%).

The 1.5% reading through the year to the September quarter was unchanged from the June quarter 2015. Inflation in the major capitals ranged from 0.2% in Canberra (and a very low annual rate of 0.6%), 0.3% in Sydney (1.9% annual) to 0.7% in Brisbane (1.5% annual) and 0.4% in Melbourne (1.4% annual).

No sign of deflation, but evidence of disinflation – like there is in many other developed and emerging economies because of the weak pace of economic activity, global trade and the continuing influence of weak oil and gas prices.