Today’s Headlines

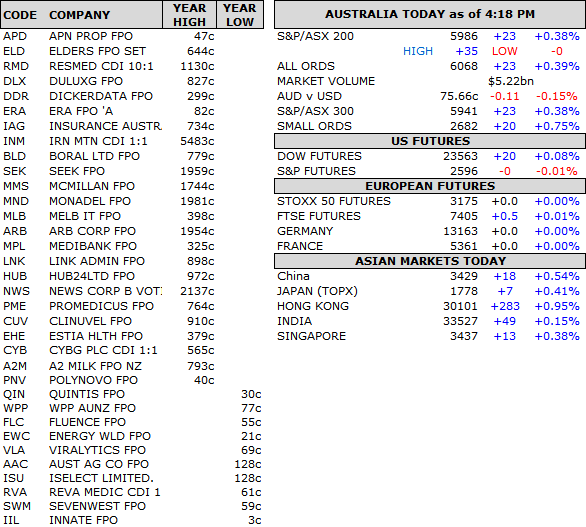

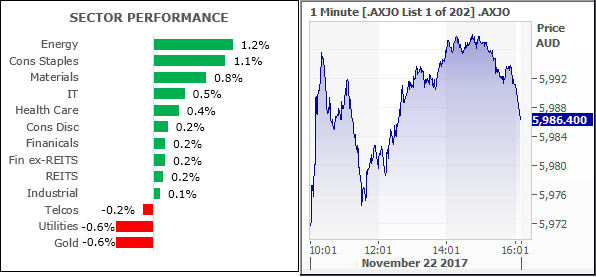

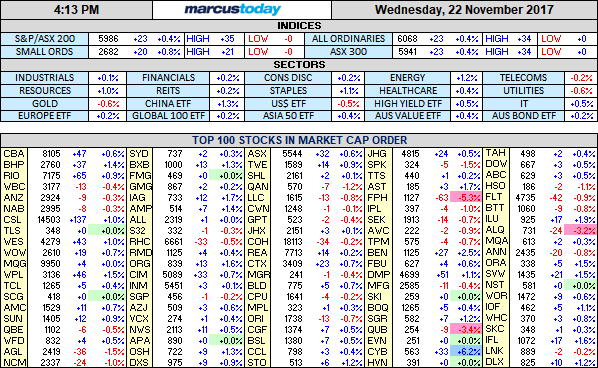

- ASX 200 up 23 to 5986 as miners lead rally.

- High 5998 Low 5972 AGMs dominate.

- Amazon set to launch tomorrow.

- Banks weaker but healthcare better.

- Consumer staples firm ahead of Amazon Ice Cream launch tomorrow.

- Iron ore firms in Asia.

- AUD bounces to 75.66c from a five-month low.

- Bitcoin US$8175 in relative quiet trade.

- US futures up 20.

- Asian markets stronger with China CSI 300 up 0.54% and Japan up 0.41%. Hang Seng up 0.95%

MT STUFF:

- MARCUS CALL – The Santa Claus rally. Ex-dividend bank switching. AGM’s to watch.

- SMALL STOCK PORTFOLIO – Henry is adding more stocks to our small stock portfolio today.

- STOCK OF THE DAY – On a trek for some income. Kathmandu is cheap with a yield and trending up.

- TRADING PORTFOLIO – One new trade.

- CONNECT WITH US – We invite you to send us your own stock ideas. We also have the facility for you to email us any questions. Click on the "Ask Marcus Today" button in the newsletter or below – Ask us anything:

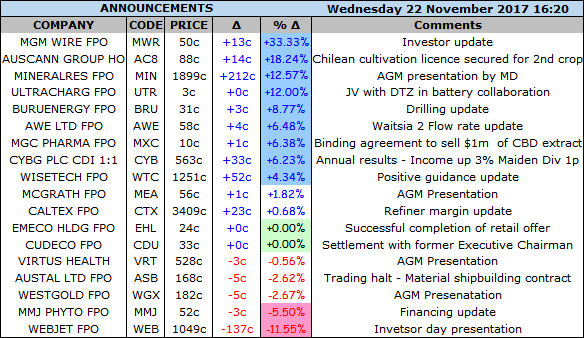

STOCK STUFF

Movers and Shakers

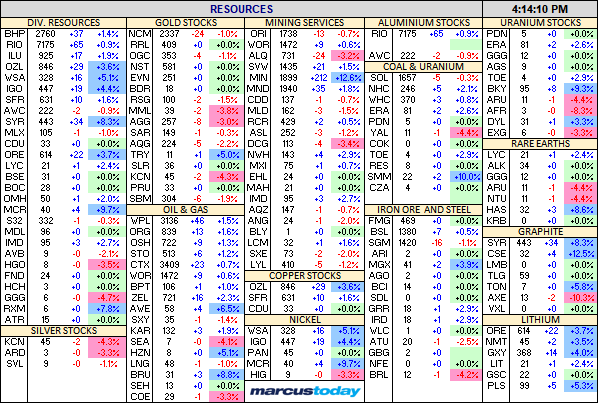

- WSA +5.13% nickel price rises.

- OZL +3.55% metal price rallies.

- BHP +1.36% higher oil and copper price drawing buyers.

- CAT -0.57% AGM presentation.

- PLS +5.32% lithium buyers return.

- SEN +10.00% broker research.

- IAG +1.66% rally continues. The quiet achiever.

- FXL +4.95% broker research.

- WEB -11.55% guidance disappoints.

- DHG +4.39% buyers emerge.

- CYB +6.23% positive cost cutting story and maiden dividend.

- WTC +4.34% positive guidance at AGM.

- FPH -5.29% broker downgrades.

- MIN +12.57% AGM presentation.

- Speculative stock of the day: QBL +30.00% ‘momentous’ deal with hemp processor. Huge volume surge.

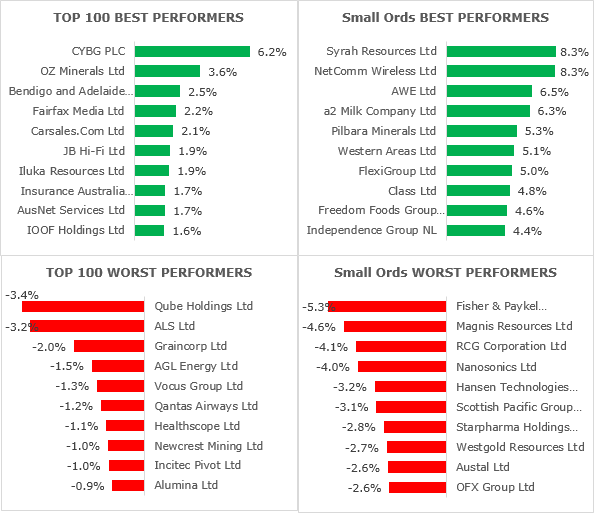

- Biggest risers – MIN, SYR, A2M, CYB, VAH and PLS.

- Biggest fallers – WEB, FPH, HUB, NAN, QUB and HSN.

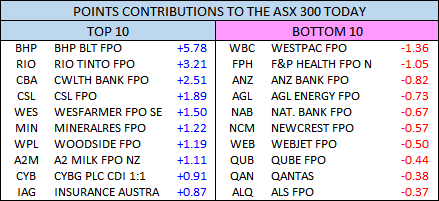

POINTS

FUTURES AND HIGHS AND LOWS

TODAY

- Webjet (WEB) –11.55% Is expecting FY18 EBITDA of $80m and TTV of $3bn. This compares to TTV of $1.95bn and EBITDA of $51m for the continuing operations reported in FY17. The company has said it expects negative cash flow in 1H FY18 due to a one-off acquisition of European travel business JacTravel.

- Sonic Healthcare (SHL) +0.09% has reaffirmed its full-year earnings guidance. Underlying earnings will grow by 6 to 8% on a constant currency basis compared to $889m in 2016/17.

BEST AND WORST

ECONOMIC NEWS

- Commonwealth government makes its first investment in Bitcoin with a joint project with Power Ledger.

- Ninth MP/Senator resigns. Xenophon party senator was British.

- The price of milk products dipped to an eight-month low overnight.

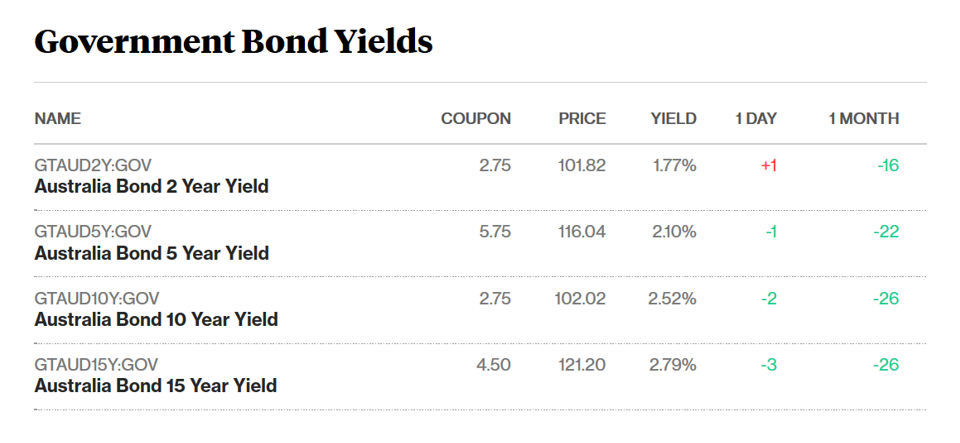

BOND MARKET

ASIAN MARKETS

- Japan’s Nippon Paint has submitted an all-cash takeover offer for rival Axalta Coatings System, prompting the US company to break off merger discussions with Akzo Nobel.

- Hong Kong stocks hit their highest level in a decade.

EUROPE AND US MORNING HEADLINES

- Meg Whitman is leaving HP after six years at the helm.

- Tesla has been burning money at a clip of about US$8,000 a minute (or US$480,000 an hour). Tesla has a market capitalisation of US$53bn. Ford Motors is worth US$48 billion. The cash will run out early August 2018.

- Former Italian PM Berlusconi is heading to court overnight to challenge his right to run for PM again. Berlusconi wants the ban for tax fraud overturned in time for a general election due by late May.

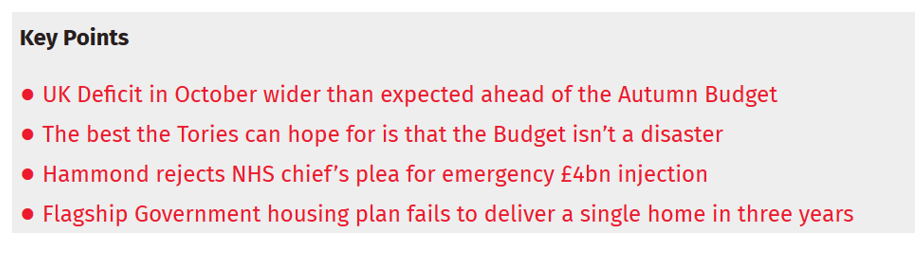

- UK Budget tonight. First non-Spring budget ever.

ANNOUNCEMENTS

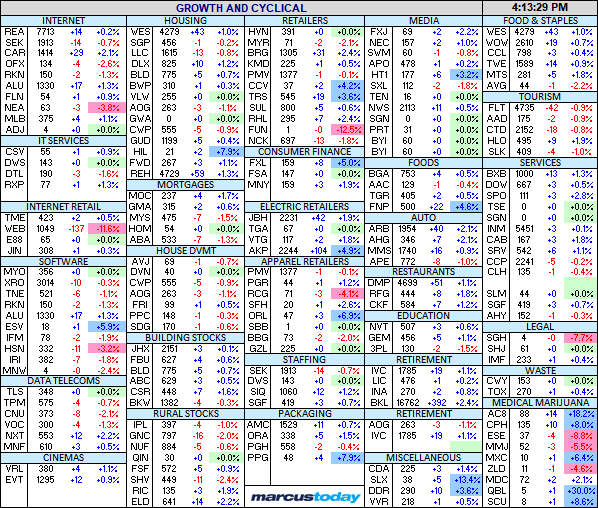

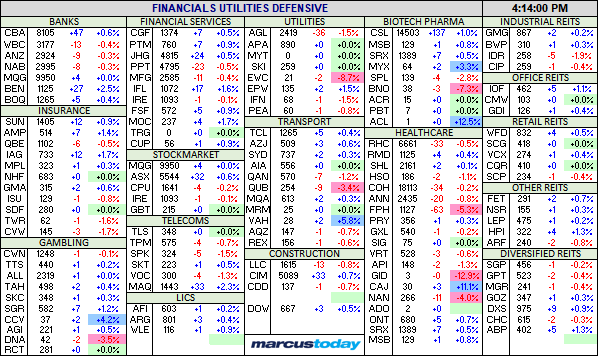

MARKET MAP

Post Views: 354