Peak earnings reporting this week as the Australian December half earnings results season sees its busiest week.

Around 70 major companies are due to report – including:

– Ansell, Brambles, GWA and Pro-Pack packaging (Monday);

– Coles Group, Seven West Media BHP, Bluescope, Scentre, Monadelphous Group and Cochlear (Tuesday);

– Fortescue, Stockland, Seven Group, Crown Resorts, Western Areas, Worley Parsons, Vocus, The Reject Shop, Greencross, Domino’s Lovisa, Stockland and Woolworths (Wednesday);

– Origin Energy, Pact Group, Platinum Asset Management, Qantas, Viva Energy, and Wesfarmers, Coca-Cola Amatil, Nine and Wesfarmers (Thursday) and

– Afterpay Touch, Alumina, Advent leisure, BWX and Reece (Friday).

The AMP’s Chief Economist, Dr. Shane Oliver says that 2018-19 consensus earnings growth expectations are around 4% for the market as a whole.

“Resources, building materials, insurance, and healthcare look to be the strongest with telcos, discretionary retail, media and transport the weakest and banks constrained,” he wrote on the weekend.

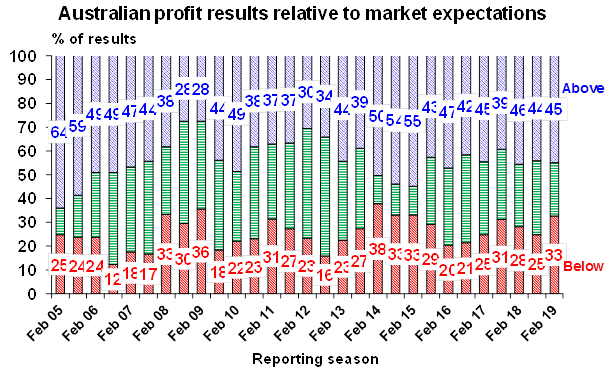

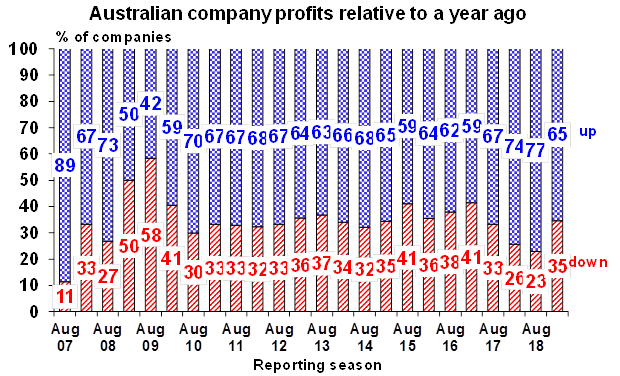

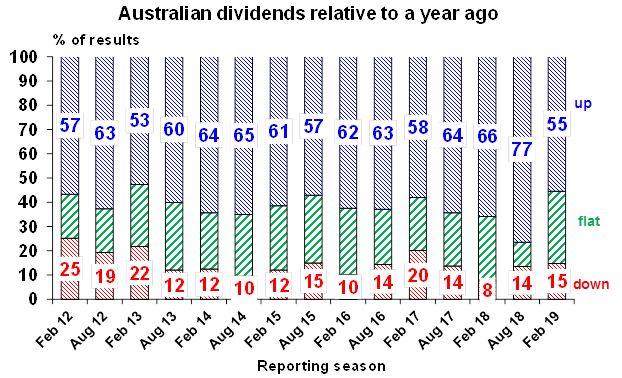

“So far about a third of results have been released. 60% of companies have seen their share price outperform on the day of reporting (which is above a longer-term norm of 54%) and 45% have surprised analyst expectations on the upside which is around the long term average, but a more than normal 33% have surprised on the downside, the proportion of companies seeing profits up from a year ago has fallen and only 55% have raised their dividends which is a sign of reduced confidence in the outlook – six months ago it was running at 77%.

“Concern remains most intense around the housing downturn and consumer spending,” Dr. Oliver added.

The results to concentrate on will be BHP, Woolworths, Nine (after the Fairfax takeover), The Reject Shop, Lovisa (for signs of the retailing turn down) and Qantas after the surprise rebound by Virgin Australia last week.