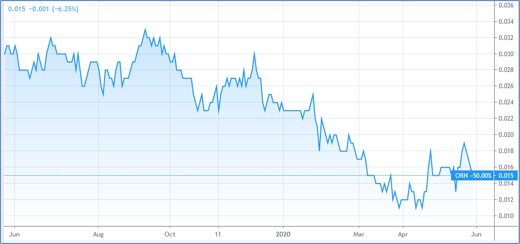

Orion Minerals – (ASX: ORN, Share Price: $0.015, Market Cap: $43m, coverage initiated @ $0.027 in Oct 2015)

Key Catalyst

Much-anticipated Updated Feasibility Study delivers substantial Increases in production, cash flow and mine life for the Prieska Copper-Zinc Project in South Africa.

Since our coverage initiation of ORN, we’ve witnessed the company’s progression from pure explorer play to emerging producer status, following the acquisition and advancement of its Areachap metals projects in South Africa’s Northern Cape. The company’s flagship Prieska Zinc-Copper Deposit was mined for 20 years from 1971, until its closure. Importantly, infrastructure is still available and useable. Prieska is a classic VMS deposit and it is the nature of these deposits that they occur in clusters. Deposit models based on similar geological setting to Prieska support ORN’s view that other large deposits are highly possible within the regional environs of Prieska, and this is supported by regional exploration results. The entry of Independence Group (ASX: IGO) onto ORN’s register during 2018 is also a testament to Areachap’s prospectivity, with a specific interest in the region’s untapped nickel exploration potential.

Latest Activity

Prieska Project Update

ORN has released the results of its much-anticipated, updated Bankable Feasibility Study for the Foundation Phase of its Prieska Copper-Zinc Project in South Africa.

Overview

The revised BFS has outlined an improved business plan compared to the previous BFS released during June 2019. The BFS confirms the potential of the Prieska Project to underpin a significant near-term, low-cost, copper and zinc development project, with exceptional opportunities for future growth.

Based on updated BFS assumptions, the project will provide excellent financial returns, for a relatively modest capital investment, given the scale of operations envisaged and the fact that this development is intended as a new production hub within a highly-endowed but under-explored volcanic massive sulphide (VMS) copper-zinc and intrusive nickel-copper district, with significant long-term exploration potential.

Results

The updated BFS delivers numerous impressive improvements on the previous study, which was completed during June 2019, which include:

– a 43% increase in undiscounted free cash flows to A$1.6 billion, pre-tax (A$1.2 billion post-tax).

– a 36% increase in NPV (at an 8% discount rate) to A$779 million, pre-tax (A$552 million post-tax).

– a five-month reduction in the capital payback period to 2.4 years.

– a 6% decrease in all-in-sustaining costs to US$3,531/t (US%1.60/lb) of copper-equivalent metal sold.

– a 3% increase in all-in-sustaining margin to 47%.

– a 5% increase in pre-tax IRR to 39%.

– a 9% increase in peak funding requirements to A$413 million to cater for the operational improvements.

– a 20% increase in copper concentrates sold of 226kt, and a 17% increase in zinc concentrates sold to 680kt.

– a 30% decrease in the shaft dewatering timeline with the incorporation of a water treatment plant.

– a 20% extension of mine life from 10 years to 12 years.

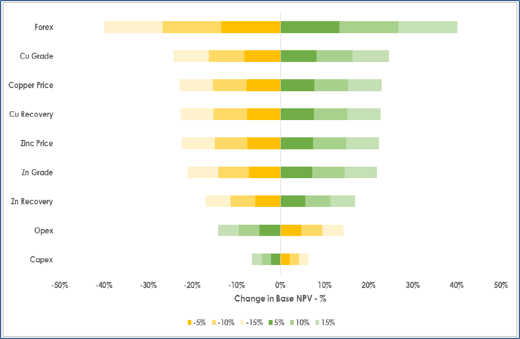

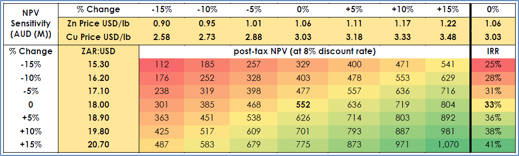

Financial Sensitivity

The NPV estimate is most sensitive to the ZAR-USD foreign currency exchange (Forex) rate and least sensitive to project capital expenditure. Post-tax NPV ranges from A$329M (-40%) to A$775M (+40%) as the applied ZAR-USD Forex rate is varied from -15% to +15% of the base assumption of 18.0. Post-tax IRR ranges from 25% (-26%) to 41% (+23%) as the assumed ZAR-USD Forex rate varies from -15% to +15%.

Figure 1: Sensitivity of the post-tax NPV to changes in key project parameters for the Prieska Project BFS.

The sensitivity of the post-tax NPV and IRR to changes in Forex rate and metal price assumptions is further illustrated in the following graph.

Figure 2: The effect of fluctuations in metal prices and foreign currency exchange rates on the post-tax NPV and IRR for the Prieska Project. The base case scenario post-tax NPV (at 8% discount rate) is A$552m, with a post-tax IRR of 33%.

Technical Significance

The BFS is an important milestone in terms of the commercialisation of the project, underling its robust economics and significant areas for growth and expansion.

The BFS has exceeded my expectations in terms of the gains that have been achieved in so many areas of the proposed development, when compared with the 2019 study.

For example, the forecast pre-tax cashflow figure of A$1.6 billion over the expanded 12 years of mine-life is enormous, along with the estimated pre-tax NPV of A$779 million. To put the NPV figure into its proper context, ORN’s market value at present is just 1/18th of the forecast project NPV.

The project promises to be highly profitable, with a 47% all-in-sustaining margin, meaning the capital payback period has been reduced to less than two-and-a-half years.

Meanwhile, there is further scope to significantly extend the mine life, given that the deposit remains open both at depth and along strike. Potential satellite discoveries both near-mine and within the broader region provides the opportunity to potentially operate in this district for many decades to come.

Given the ~3-year construction period, the Prieska project would likely be entering the market during 2024 at a time of strengthening copper demand, yet with few new world-class sources of supply available.

The robust BFS results will hopefully assist ORN in terms of successfully concluding its project financing discussions.

Project Overview

The Prieska Project is located within the Northern Cape Province of South Africa. The Prieska Copper Mine (PCM) ceased operations during 1991 and a conditional mine closure certificate was issued in 1995.

The mine was previously owned and operated by Prieska Copper Mine Limited, a subsidiary of Anglo-Transvaal Consolidated Investment Company Limited (Anglovaal). The decision to close the mine was influenced by a combination of the uncertain economic and political environment in South Africa during the mid-1980s, along with the technical considerations that arose as the mine got deeper and the spatial orientation of the mineralisation changed. The technical considerations relating to the mining of the flattened deposit no longer present a major challenge, as modern mechanised mining methods present a ready solution to the historical challenges.

Summary

We have long believed Prieska represents a highly valuable strategic asset with the potential to become a significant source of high-quality copper and zinc concentrates, which are highly sought-after in global markets. The BFS has confirmed Prieska’s potential to underpin a significant low-cost, copper and zinc development project, with exceptional opportunities for future growth. Based on BFS assumptions, the project will provide excellent financial returns for a relatively modest capital investment, given the scale of operations envisaged. The proposed production hub is situated within a highly-endowed but under-explored volcanic massive sulphide (VMS) district, with significant long-term exploration potential.

The hope now is that the robust BFS results will prove to be the catalyst for a near-term conclusion to the company’s project financing discussions.