Stock market levels remain quite away off recent highs despite a market rebound which has been extraordinary. Interestingly, during this period of heightened market volatility, the divergence between expensive and cheap stocks has continued to grow. This is depicted in the chart below which highlights the extreme nature of the P/E spread across the market.

Source: MST Marquee

As we look over this financial year, where we have had success, is investing in beaten up companies/industries where expectations have been low. Agriculture as an industry and specifically for the Pure Value Share Fund, Costa (CGC-AU) and Bega (BGA-AU) are recent examples. Whereas Costa is up c35% off its lows, the ASX200 is off almost 20% over the same period. Bega has outperformed even more than this. Why were there such opportunities? The market had written off near term expectations given the drought and some company specific issues. What has changed since December when these stocks bottomed? To put it simply, it rained, and the businesses now have a lot of momentum that the market has jumped on.

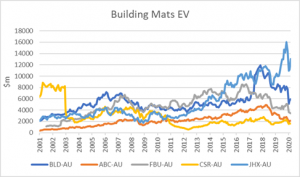

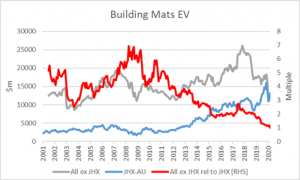

Australian building materials is an industry where we currently see similar opportunities. During May we have witnessed an extraordinary event in the space. For the first time ever, James Hardie’s (ASX:JHX) enterprise value (market cap + net debt) now equals the COMBINED enterprise value of its peers Boral, Fletcher Building, Adelaide Brighton and CSR. This is remarkable given as recently as Feb-19 these companies were twice the size of JHX. In 2008 these companies were almost 7x the size of JHX. These figures exclude the circa A$1.5b asbestos liability that James Hardie carries. Including this further inflates JHX’s value relative to the peer group by c12%.\

Source: FactSet and Perpetual Investments

To be clear we see JHX as an incredible success. The company has had a clear strategy of driving fiber cement market share predominately in the US while maintaining strong margins. The business has enjoyed structural growth in a cyclical industry. Whilst the business has enjoyed great success, it has had its challenges along the way. Competition in the segment has increased with LP significantly growing their Smartside cladding product. The company also made a significant acquisition in Europe, which to date appears to be struggling. Despite this, the market has focused on the company’s ability to grow above market to date and have capitalised this opportunity.

On the flip side are the other companies. These peers have a large exposure to Australian heavy materials as well as Australian building products. In Boral’s case they also have exposure to North American building products, the North American heavy construction market in fly ash and sales of plasterboard through Asia.

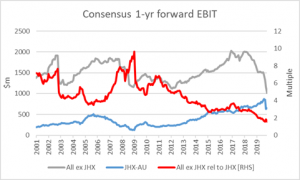

There is no doubt the macro environment for Australian housing and non-residential construction is likely to get more challenging in the near term. In addition, these companies have had, to varying degrees, competitive challenges and management turnover. Despite this, these companies are materially under earning relative to their mid-cycle earnings potential. For the most part they are trading near net tangible asset backing and, in our view, would be attractive for M&A activity. In fact, by buying the basket of peers over JHX you are paying about the same amount for 60% more earnings – for the basket ex JHX, earnings that have been more severely impacted by cyclical factors whilst for JHX margins remain above the target range – which makes this gap even more extreme.

Source:FactSet and Perpetual Investments

A valuation gap is warranted, but for the market to currently be valuing James Hardie at the same size as all these building materials companies combined appears odd and symptomatic of the current environment. Although there is no near term catalyst for a reversal, we see significant value in this basket of stocks, especially Boral and Fletcher Building. We continue to see similar opportunities across the market.