The “market” is expensive.

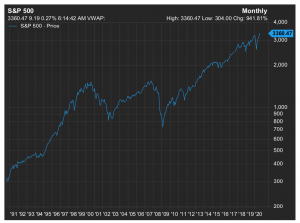

The current forward PE for the MSCI is 20x and for the US 23x. This is the highest level in 20 years and is 2.5 standard deviations above 20-year averages in the US. If you believe in markets mean-reverting this implies 30% downside for the S&P500 “index”.

But does this tell the whole story?

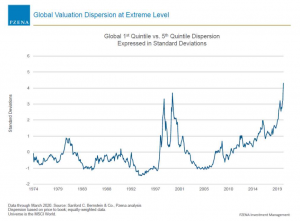

At present we have the greatest valuation dispersion among stocks since 1974 and similar to those levels last seen in the dot com boom of 2000.

Growth stocks have led the way with growth outperforming value style investing by the greatest margin since 2000.

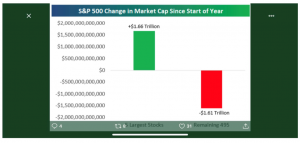

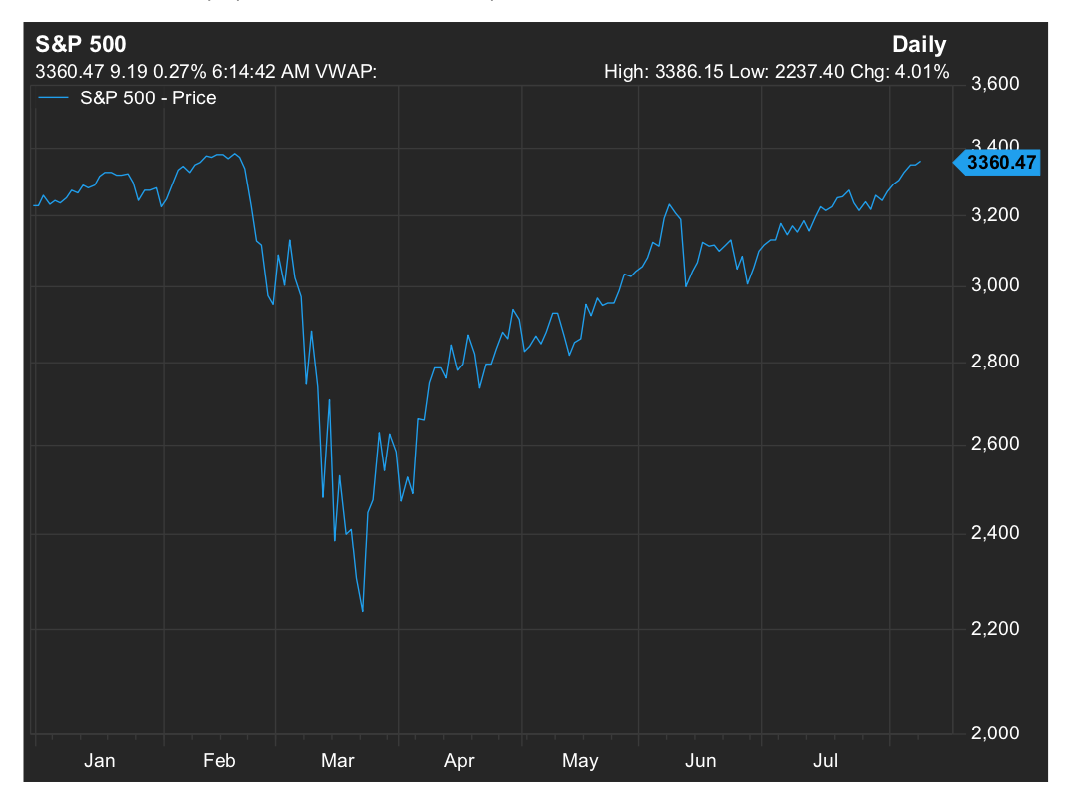

The 50% rise of the US S&P 500 index from its lows in March has been driven by a narrow number of titans.

In fact, 5 stocks have increased their market cap by the same amount as the other 495 have lost since the beginning of the year.

The S&P index has powered ahead of profits driven by PE expansion not valuations driven.

With the US market now over 2 standard deviations above the rest of the world.

So where does this leave us?

The S&P500 is only up 4% CYTD so what’s the problem?

Does the index tell the whole story?

It may be different this time, but the result will be the same.

The herd is moving in the same direction and the index has powered ahead from the lows in March led by a narrow group of stocks.

WHAT COULD POSSIBLY GO WRONG?

Don’t buy the index, buy value for long term investing, and capital preservation. There are cheap stocks in an expensive index. The index at the moment is an irrelevant benchmark in finding value.