The Australian June profit reporting season peaks this week with some high-quality corporates reporting.

Reports are expected from at least 40 ASX 200 companies.

These include Argo Investments, Bendigo and Adelaide Bank, Altium, Kogan, Lend Lease, Amcor, BlueScope Steel and JB HiFi (today); BHP, Cochlear, and Coles (Tuesday); Vicinity Centres, CSL, Monadelphous, Domino’s Pizza, Brambles, WiseTech, OZ Minerals (half-year) and Tabcorp (Wednesday); the ASX, Coca-Cola Amatil, Qantas, South32, Webjet, Southern Cross Media, Sonic, Origin Energy and Wesfarmers (Thursday) and Suncorp, BWX, TPG Telecom and Mayne Pharma (Friday).

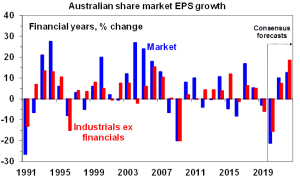

Consensus expectations remain for a 21% slump in earnings due to the hit from coronavirus.

Financials will be the hardest hit with an expected -29% slump in earnings led by insurers and the banks, followed by industrials with a -15% fall in earnings and resources with -12%. Consumer discretionary may be the only sector to see a rise. Coles Group will test that thesis tomorrow.

Up to Friday, only around 15% of companies representing 28% of market capitalisation having reported so far.

The AMP’s chief economist, Dr Shane Oliver says it’s clear that company earnings have been hit hard by coronavirus.

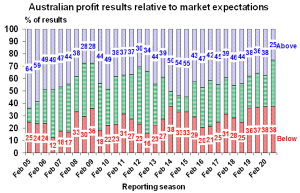

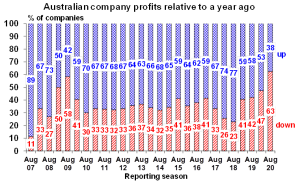

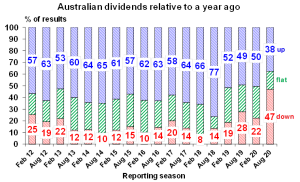

“So far only 25% of results have exceeded expectations compared to a norm of around 44%, only 38% of results have seen earnings rise from a year earlier (compared to a norm of 66%) and 47% have cut dividends (compared to a norm of just 16%),” Dr. Oliver said in his weekly note on the weekend.

“That said so far consensus earnings expectations for 2019-20 have only slipped slightly to -21.2% (from -21% two weeks ago) so it’s still roughly in line with overall expectations.

But Dr. Oliver points out that this would be worse than the -20% earnings decline in the GFC and the worst fall since the early 1990s recession.

See the final profit chart below.