Trying to pick the winner of the COVID-19 vaccine race is as difficult as picking a winner during the spring carnival.

Investors would be better served with a broad and global approach to health care investing rather thanbetting on the vaccine sweepstakes.

While there are over 150 coronavirus vaccines under development globally, by most accounts there are nine candidates in stage three trials or beyond, raising global hopes that several will be available for widespread distribution during the first half of 2021. [1] Unsurprisingly, investors have been looking ahead to the potential winners of what we call the “COVID-19 sweepstakes,” injecting a significant dose of volatility into what is already a highly uncertain investment environment. Betting on a winner or two, though, requires a high degree of faith given that the business case for these vaccines—not to mention the science—is still uncertain.

The challenges for vaccine manufacturers are many. Putting aside for a moment the fact that there is no certainty yet about the efficacy—and durability—of any of the vaccines under development, the atmosphere in which these companies are operating is politically sensitive and being watched more closely than any drug development process in history. Furthermore, pricing for potential vaccines is still uncertain, the competitive landscape unknown and the means of allocating doses globally will require a delicate balancing act fraught with political pitfalls. Add in the fact that many of the share price gains in most of these stocks might already be pricing in regulatory approvals and it becomes clear that the upside is probably very limited and not commensurate with the downside for a vaccine maker that fails to clear all regulatory hurdles.

A better approach to health care investing, in our view, is one less focused on the outcome of binary pass or fail events (as many biotechnology investors know too well) and more focused on companies that are proven compounders of growth across the entire spectrum of specialties in one of the world’s most dynamic economic sectors. In this sense, the coronavirus pandemic provides potential growth beyond vaccines. For starters, the ongoing global health crisis has raised awareness about the importance of sturdy, reliable and efficient health care systems to deal with challenges in the future. In this, the private sector has shone the brightest, rapidly coming up with solutions to a truly global crisis. Investors have rapidly come to realise the importance that technology plays in not only helping to develop new solutions but also in delivering them to patients, in creating safe medical environments and in building an entire ecosystem around patient outcomes and improved care. The COVID-19 crisis has accelerated the drug development and testing process, drastically compressed trial and regulatory approval timelines, driven massive investment into the sector globally and served as a massive catalyst to propel innovation. As a result, we expect the next few years to be a very exciting time for health care investors globally.

The MarketGrader Developed Markets (ex-Australia) Health Care Index (HLTH Index) is a very good and representative microcosm of all the areas of opportunity in health care investing globally that have come to the fore since the outset of the pandemic. And while the HLTH Index has broad exposure to COVID-19 vaccine developers as well as to some of the companies more active in the therapeutics space, it also has a world-class collection of companies that provide much of the infrastructure that supports the vibrant ecosystem that has been mobilized to address the defining health care issue of our time, while delivering excellent long-term shareholder value. Below we explore a few areas—and companies—worth highlighting.

The suppliers and the infrastructure providers

In addition to the challenge of developing, testing and getting approval for multiple vaccines that are effective, safe and durable, health care authorities and governments around the world are dealing with the challenge of figuring out how to distribute them equitably and efficiently to the world’s population. Several developed or large countries have locked in contracts for the manufacturing of hundreds of millions of doses of various vaccines with the drug manufacturers well before any of the vaccines have been approved. These include the United States, Russia, China, Australia, [2] and the European Union, to name a few. [3] Lost in the discussion is who actually does the manufacturing, storing, transportation and delivery of such vaccines. That role usually falls to contract manufacturers and suppliers to the pharmaceutical industry—call it the “picks and shovels” of health care. HLTH Index includes several of these among its constituents, which are actively engaged in the fight against COVID-19.

West Pharmaceutical Services (NYSE: WST)

Market Capitalization: US$ 19.9 billion

MarketGrader Score: 68.0

West Pharmaceutical Services is one of the largest contract manufacturers to the pharmaceutical industry in the world. The company specializes in manufacturing vaccines, pharmaceuticals, biologics and consumer health care products. It offers holistic solutions to the complex process of manufacturing drugs including all of the steps needed for a company to take a drug from inception and prototype all the way to market. It also manufactures daily-use products such as vials, containers, syringes and the hundreds of basic components and materials used across hospitals, laboratories and doctors’ offices every day around the world.

Hologic, Inc. (NASDAQ: HOLX)

Market Capitalization: US$ 16.7 billion

MarketGrader Score: 64.3

Hologic manufactures and supplies diagnostic and testing products, critical components in the fight against COVID-19. This includes not only the assays (the actual tests that measure the presence of the SARS-CoV-2 virus in patient samples) but the instruments that run thousands of these tests per day at high throughput rates. The global installed base of Hologic’s testing machines is capable of running 1.8 million COVID-19 tests daily, with results available in under four hours. [4]

The vaccine players

Among the group of companies that are currently running the vaccine trials that are the furthest along (phase 3), two are members of HLTH Index (JNJ and PFE). A third one (GSK) is not in as advanced a stage but nonetheless in human trials since early September. Here’s a quick synopsis of where these three Index members are in their development and trial process.

Johnson & Johnson (NYSE: JNJ)

Market Capitalization: US$ 383.5 billion

MarketGrader Score: 61.2

JNJ’s vaccine is among the group of “viral-vector” vaccines, which essentially uses a weakened virus to transport pieces of the pathogen into patients in order to elicit an immune response. The company announced on September 23 the launch of its phase three trial, among 60,000 adults across multiple countries.

Pfizer Inc. (NYSE: PFE)

Market Capitalization: US$ 202.2 billion

MarketGrader Score: 61.0

Pfizer’s vaccine is also among the “viral-vector” group, which the company is developing in partnership with BioNTech, a German biotechnology company that trades on NASDAQ (BNTX) but that is not a member of the Index. After Moderna (MRNA, also not in the Index), Pfizer has perhaps the trial that is the furthest along. The company began a combined phase two and three trial in late July that includes 44,000 patients also across multiple countries. The company also signed a US$ 2 billion contract with the US government for the provision of 100 million doses by December (assuming a successful completion of its trials and regulatory approvals). Furthermore, the company aims to make 1.3 billion doses by the end of 2021.

GlaxoSmithKline plc (London Stock Exchange: GSK)

Market Capitalization: US$ 93.5 billion

MarketGrader Score: 66.8

GSK’s vaccine, which is being developed in collaboration with Sanofi (SNY, not an Index member), is a few months behind JNJ, Pfizer and Moderna (all of which expect to complete trials by year end). The companies expect to begin phase three trials before the end of 2020 and to clear regulatory approvals in the first half of 2021. However, unlike the other vaccines being developed much more rapidly that use new and relatively unproven technologies, GSK’s efforts are being watched very closely and widely anticipated since the vaccine is based on a more established approach that is used in one of GSK’s flu vaccines. GlaxoSmithKline and Sanofi already have in place contracts with the US and UK governments as well as the European Union to provide almost 900 million doses following approval. Additionally, GlaxoSmithKline has partnered with infectious disease specialist Vir Biotechnology (VIR, not an Index member) in the development of a SARS-CoV-2 therapeutics regimen.

The therapeutics players

As doctors and scientists have developed a better understanding of the novel coronavirus, the pharmaceutical and biotechnology industries have once again led in the development of therapeutics to treat COVID-19 that are expected to deliver better patient outcomes, especially if one assumes vaccines will not be widely available to the general population globally until perhaps the second half of next year. Besides, inoculating the world’s population does not mean the virus will go away; instead, it is likely to linger around for a long time—not unlike the flu—which will require effective treatments well into the future. This offers a unique opportunity to the companies developing effective treatments that can also be easily administered (such as a pill as opposed to an infusion) and distributed widely on a global scale. This is another area where several HLTH Index members are leading global suppliers in the development of COVID-19 treatments, while also providing investors with additional alternatives to all-or-nothing bets on single drug approvals. The following are some of the most promising prospects for new therapeutics in development by some of HLTH’s Index members.

Merck & Co. (New York Stock Exchange: MRK)

Market Capitalization: US$ 209.3 billion

MarketGrader Score: 69.7

Merck is not only the world’s third largest Major Pharmaceutical company, but it is also the highest rated company in its sub-industry in North America (including large global pharmaceutical companies available on the US exchanges as ADRs), according to MarketGrader. It also happens to have under development one of the COVID-19 therapeutics that most excites both the medical and investment communities, in large part because it is administered orally rather than intravenously as is the case for Remdesivir. Assuming that Merck’s antiviral pill proves effective and meets with regulators’ approvals, analysts argue that it could become a staple of the seasonal fight against COVID-19, which many scientists believe could become as prevalent as influenza is today. [5] Merck, by the way, also has a COVID-19 vaccine under development, though it trails its peers in expected approval and time to market.

Regeneron Pharmaceuticals (NASDAQ: REGN)

Market Capitalization: US$ 60.8 billion

MarketGrader Score: 76.7

Regeneron has been the leader so far in the development of treatments that use monoclonal antibodies. Its product is expected to receive emergency use approval by the end of 2020, followed by full approval next year. Regeneron also happens to be the fourth highest graded biotechnology company in the US, according to MarketGrader, a field that includes 262 companies. Perhaps more impressively, it ranks 18th globally based on the strength of its fundamentals, among a peer group of 615 publicly traded biotechnology companies across all regions of the world.

Other fronts in the COVID-19 fight

Other companies are proving to be critical players in the global fight against the novel coronavirus, even if they don’t receive the same amount of press that the vaccine and therapeutic makers get. Many of them are in the Medical Specialties, Managed Health Care and Medical or Nursing Services industries, all of which are represented in HLTH Index. In fact, 44% of Index members are in areas not related to drug development or manufacturing. This should help investors diversify their health care exposure, especially considering that drugs account for only 15% to 20% of health care expenditures globally. [6] Two Index members in this category worth highlighting appear below.

DiaSorin S.p.A. (Milan Stock Exchange: DIA)

Market Capitalization: US$ 10.9 billion

MarketGrader Score: 60.4

With the onset of fall in the northern hemisphere and with it the arrival of cold winter weather and the flu season, medical professionals worry about an influx of patients with flu-like symptoms that, at first, might be undistinguishable from COVID-19 patients. Many specialists thus fear the stress this will put on testing, doctors, hospitals and entire health care systems, akin to the pressures that led to the near-collapse suffered by some health care systems in some parts of the world during the early days of the pandemic in the spring (Wuhan, Northern Italy, New York). DiaSorin, an Italian company that produces kits for in vitro diagnostics, recently received approval from the Food and Drug Administration (FDA) in the US for one of its flu test kits, which can be used to differentiate between cases of influenza and COVID-19. [7] This, of course, could be among the solutions that determine whether health care systems become overwhelmed or not during the upcoming flu season.

ResMed Inc. (New York Stock Exchange: RMD)

Market Capitalization: US$ 24.9 billion

MarketGrader Score: 68.3

Although ResMed specialises in the treatment of sleep apnea and other sleeping disorders, the company has leveraged its expertise in developing and manufacturing respiratory support devices to produce more than 150,000 ventilators, which it has shipped to 140 countries. According to the company, between January 1 and June 30th, critical months in the early COVID-19 fight, ResMed produced three and a half times the number of ventilators it produced in the first six months of 2019.

This is by no means a comprehensive guide to the investment landscape surrounding the global fight against COVID-19. Instead, it is meant as an illustration of the resources, ingenuity and drive that private enterprise has brought to bear during the crisis, as well as the opportunity investors have in health care globally once they look past the names that regularly make the evening news.

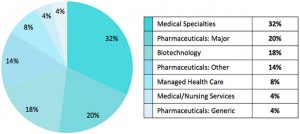

VanEck Vectors Global Healthcare Leaders ETF (ASX: HLTH) tracks the MarketGrader Developed Markets (ex-Australia) Health Care Index and it provides investors a unique combination of concentration in the world’s most fundamentally sound health care companies with diversification that goes beyond a few drug makers. This is illustrated in Figure 1. And while the 12 companies included in this article account for only about a quarter of the Index’s weight, they provide a good representation of the quality and diversity available in the portfolio.

Figure 1. MarketGrader Developed Markets (ex-Australia) Health Care Index Breakdown by Sector, 30 September, 2020.

ENDNOTES

[1] National Geographic. “Dozens of COVID-19 vaccines are in development. Here are the ones to follow.” September 24, 2020.

[2] Australian Government Department of Health. https://www.health.gov.au/news/australia-secures-onshore-manufacturing-agreements-for-2-covid-19-vaccines

[3] Axios. “Global coronavirus vaccine initiative launches without U.S. or China.” September 24, 2020.

[4] Source: the company. https://www.hologic.com/creation-second-assay-novel-coronavirus-hologic-dramatically-contributes-meeting-worlds-acute-need

[5] Bloomberg. “Merck Antiviral May Displace Scrutinized Covid-19 Therapies.” August 25, 2020.

[6] Barrons. “10 Stocks to Buy as the Health Care Revolution Races Ahead, According to Experts.” September 28, 2020.

[7] McKnight’s Long-Term Care News. “FDA clears DiaSorin test that differentiates between COVID, flu.” September 8, 2020.

[8] All company market capitalizations, MarketGrader Scores and Index industry breakdown are as of September 30, 2020. Source: MarketGrader.