The US December quarter earnings season slows this week but after the first three weeks or so of the reporting period it looks like American companies are on track to post earnings growth for the fourth quarter of 2020.

The company week sees a decline in the number of companies reporting after last week’s peak.

Reporting companies this week include Cisco Systems, Coca Cola, General Motors, Fox Corp and Walt Disney.

Leading US-based data firms Refinitiv and FactSet have now switched the earnings season forecast from a gradually shrinking decline to a small but outright rise.

If the current projection holds for the next couple of weeks – when most US retailers will report including troubled giants like Macy’s – it would be the first quarter of profit growth for S&P 500 companies since the end of 2019.

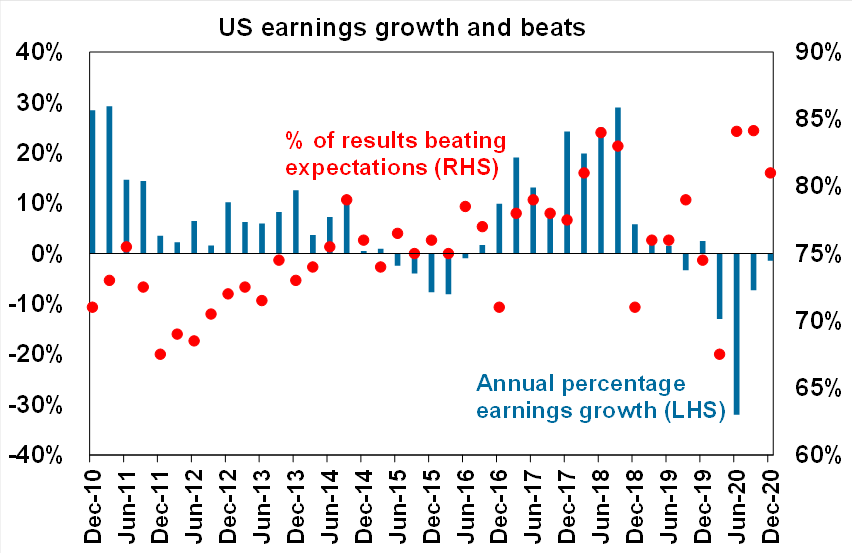

Refinitiv says that S&P 500 earnings are expected to have risen 0.9% in the fourth quarter of 2020 from a year ago. That’s far better than the start of season fall of just over 10% at the start of January.

FactSet wrote on Friday more S&P 500 companies are now beating EPS estimates for the fourth quarter than average, and beating EPS estimates by a wider margin than average.

“As a result, the index is reporting higher earnings for the fourth quarter today relative to the end of last week and relative to the end of the quarter.

“Due to this increase in earnings, the index is now reporting year-over-year growth in earnings in Q4 2020 for the first time since Q4 2019.

“Analysts expect double-digit earnings growth for all four quarters of 2021.”

Other US companies down to report this week include Tyson Foods, toy giants, Hasbro and Mattel; Hanesbrands (clothing), Goodyear Tyre, Yelp, Lyft, Twitter, Zillow, Pepsi, Moody’s, S&P Global, UnderArmour, Dupont, Bunge, Kraft Heinz, Newell Brands, Kellog and NCR.

Shell has a global strategy update mid-week.

And the AMP’s Dr Shane Oliver is more more optimistic about the US outlook.

He wrote at the weekend “US earnings are back to around pre coronavirus levels. The US December earnings reporting season is now about 57% complete, with results remaining strong.

“81% of companies have so far surprised on the upside (compared to a norm of 75%) by an average 19% and 75% have beaten on revenue.

“As a result, consensus earnings expectations have been revised up to around flat from a year ago which is up from -9% two weeks ago.

“In other words, earnings are back around pre coronavirus levels, Dr Oliver wrote.

Source: AMP Capital